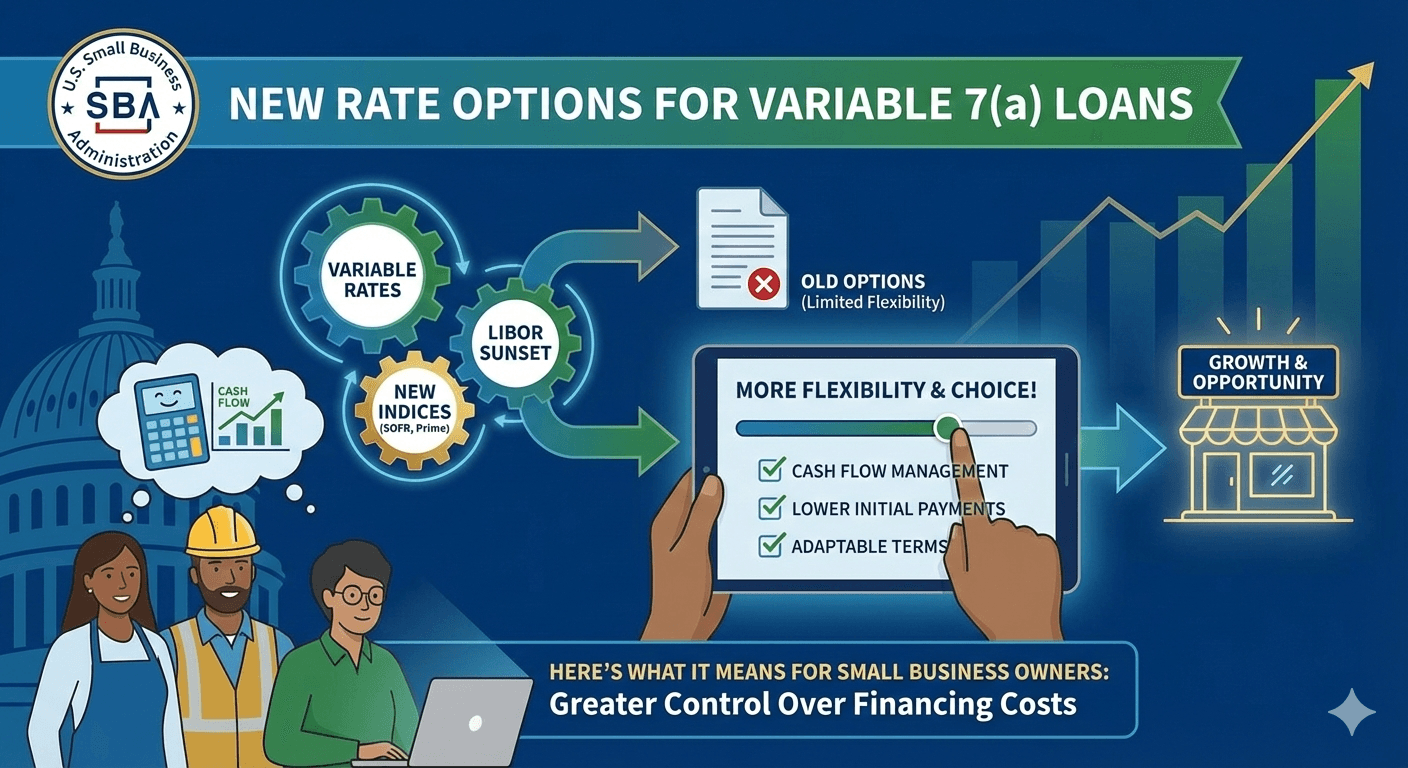

SBA Just Added New Rate Options for Variable 7(a) Loans — Here’s What It Means for Small Business Owners

If you’re shopping for an SBA 7(a) loan (especially a variable-rate one), there’s an important update to know about.

On February 6, 2026, the SBA issued a procedural notice, and on February 10, 2026, it published a notice in the Federal Register announcing new “Alternative Base Rate” options that lenders can use to price variable interest rate loans under the SBA 7(a) Loan Program. These changes take effect March 1, 2026.

What’s a “base rate” anyway?

For variable-rate loans, your interest rate is typically:

Base Rate + Spread

-

The base rate is a widely tracked benchmark (like Prime).

-

The spread is the lender’s added percentage, and the SBA has rules that limit how high the total rate can go based on loan size.

Until now, SBA 7(a) variable-rate lenders generally used:

-

Prime rate, or

-

SBA Optional Peg Rate

What changed: 3 new base rate options

Starting March 1, 2026, the SBA will permit lenders to use three additional base rate choices for variable-rate 7(a) loans:

-

5-year Treasury Note Rate

-

10-year Treasury Note Rate

-

SOFR (Secured Overnight Funding Rate)

A quick SOFR note (important detail)

The SBA also clarified that lenders may continue using their in-house SOFR reference rates of 30 days or less (since many banks use SOFR-based “term” or internal products that closely track daily SOFR).

Will this lower your SBA loan rate?

Maybe — but not automatically.

Here’s the key point: even if a lender uses an alternative base rate, the SBA still caps the maximum rate. The SBA stated that when using an Alternative Base Rate, the maximum interest rate cannot exceed Prime + the allowed spread for that loan amount.

So in plain English:

-

Alternative base rates may give lenders more flexibility in how they structure variable-rate pricing.

-

Your final rate still has guardrails.

-

Whether your rate is lower depends on market conditions (Treasury/SOFR vs Prime) and the lender’s spread/offer.

What this means for owner-operators and home service businesses

If you’re a blue-collar or home service operator (HVAC, plumbing, electrical, landscaping, hauling, etc.), this change mostly impacts you in two ways:

1) More lender flexibility = potentially more approvals

Some lenders prefer pricing off Treasury or SOFR because it aligns with how they manage funding costs. More flexibility can mean more lenders willing to offer variable-rate 7(a) loans.

2) More rate “formats” to compare

When you’re comparing offers, don’t just look at the APR headline—ask:

-

“What base rate are you using (Prime, Peg, Treasury, or SOFR)?”

-

“What’s the spread?”

-

“How often does it adjust?”

-

“Is there a floor or minimum rate?”

This helps you compare apples-to-apples.

One more technical note: secondary market eligibility

Right now, SBA said loans using alternative base rates are not currently eligible for secondary market sales, but it will evaluate demand. This is more of a lender-side detail, but it could influence which lenders adopt the new options first.

What to do next (simple borrower checklist)

If you’re considering an SBA 7(a) loan soon:

-

Ask your lender what base rate they use for variable-rate 7(a) loans starting March 1, 2026

-

Compare total pricing, not just the benchmark

-

If you want predictability, ask about fixed-rate 7(a) options too (when available)

-

If speed matters, ask whether SBA Express or alternative products are a better fit for your timeline

Want to check your SBA 7(a) options?

If you want to see what you might qualify for (and compare paths like SBA 7(a), SBA Express, term loans, and lines of credit), click below!